Author Archives: Colleen

Join Me March 15 “Meet The Author” Day!

Android Factoid : Permission to What?

We’re all familiar with the saying “the devil is in the details.” When it comes to downloading apps, it might be worthwhile to check out the developer’s details before allowing access to your smart device especially if you’re using an Android. You may inadvertently give permission to complete strangers to mine your personal data and use as if it were their own.

Apps for Androids use open source software as the basis for each program meaning it is available to the general public and open to any and everyone. There are no safety features built in to protect your personal data and some apps infiltrate your device when you agree to their terms.

The developers at Apple must meet certain guidelines and submit their programs for approval. If it isn’t approved it cannot be listed or sold. This is NOT an endorsement for Apple products – it is a comparison to help consumers understand the choices they make when dealing with Apple and Android apps.

Take a moment to read before you click on agree and make sure you are comfortable with your decision to purchase an app. They are not all the same and there is no generic warning or advice in place. Small print can make a big difference in how and what you buy. Common sense is the best approach to using your purchasing power and there is no app for that!

Radio Interview Mar. 22, 2015 Stay Tuned! KXRN 93.5 FM

I will be doing a radio interview on March 22,2015 with Greg Friedman on KXRN 93.5fm Laguna Beach’s only FM station. For updated info please visit http://kx935.com/show/innerjourney

Senior Learners Institute Registration Info

Thanks to Ocala’s Good Life Magazine For Their Support

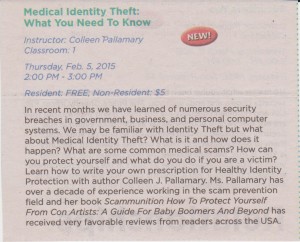

Upcoming Medical Identity Theft Presentation

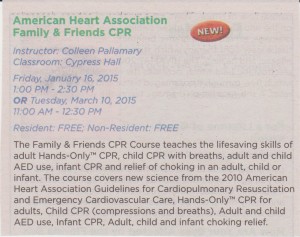

Upcoming Classes at Master The Possibilities

Happy New Year Cover Story 2015!

Grateful to Ocala The Good Life Magazine for featuring Scammunition as their cover story! Here’s how to take a peek! http://bit.ly/1D7vHd6

Grateful to Ocala The Good Life Magazine for featuring Scammunition as their cover story! Here’s how to take a peek! http://bit.ly/1D7vHd6

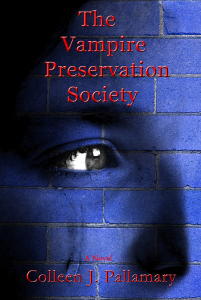

Debut Novel The Vampire Preservation Society Released

http://www.prweb.com/releases/TheVampirePreservation/Society/prweb12393302.htm

http://www.prweb.com/releases/TheVampirePreservation/Society/prweb12393302.htm

Available on Amazon.com !